Hi Everyone,

In March we have significantly enhanced our MICR engine, in such a way that we announced the new performances and improvements in a press release.

But this was before last week’s release, which brought even better performances to the toolkit.

We’re proud to have a fast and robust tool that can be a strong base for any banking and financial application.

So we thought it was a good opportunity to write a recap article about MICR and present our tool to those who are not using it yet.

What is MICR?

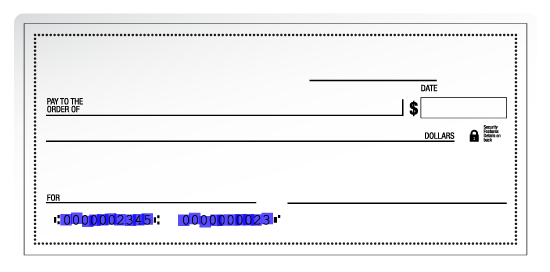

MICR stands for Magnetic Ink Character Recognition.

The MICR technology uses magnetic ink on cheques for automatic reading and security reasons. Indeed, the magnetic ability makes the clearing of cheques faster, and the special ink and printers mitigate check fraud.

If you wish to know more about the history of MICR (the technology was invented in the fifties!), you can read the article we wrote on the ORPALIS blog.

So, MICR is a standard encoding technology and it uses two different fonts, E-13B and CMC-7.

The MICR line is located at the bottom of a cheque.

Both MICR fonts use the 10 decimal digits and a set of additional symbols that provide the document type indicator, bank code, bank account number, check number, the amount, and a control indicator.